The world is dividing into two camps. Those two camps are turning out to be just as unequal as two previous camps were.

Once upon a time there were what we used to call First World countries and Third World countries. (I’m not quite sure why there were no second class countries, but that’s how things were.)

The division was ridiculously uneven. The wealth was concentrated in seven countries to start with, then the grouping rose to twenty. But the majority of the world was definitely third class.

However, things have not been standing still around the world. Those third world countries are going places, and some are definitely emerging, and some have already emerged. Those countries are scrambling to align themselves with the BRICS+ group, and they currently comprise two-thirds of the world’s population.

At the same time, the original G7 countries, and friends, are declining in wealth, security and prospects.

Let’s have a look at some of the problems besetting North American countries, and West European countries.

First and foremost they are bankrupt, which means they are operating debt trap economies. Operating by using debt is a great way to succeed quicker than without taking on debt, but there is a catch, and it is very easy to avoid. It’s based on elementary maths.

Every deal you decide to embark upon needs to be based on a fundamentally sound mathematical equation.

Set in ordinary language such an equation could look like this:

Profit from doing business minus Cost of doing business plus The cost of any borrowed finance should produce a profit.

In other words you want a mathematical equation looking something like this:

(Operations cost O + Money cost M) = Result R

Such an equation must produce a profit. In other words R must be a positive number.

If R is a negative then you are working to lose money which is absurd. The only reason you would do that is if you were in for the long term, and you expected that operation one was bound to lose money, but as things progressed the losses would drastically reduce until you started to make a profit.

Unfortunately there is a limit to how much of a loss you can handle. In complex business transactions once your losses begin to exceed 90% of your collateral you cant sustain any further losses without getting irremediably further into debt. The reason for that is simple. Once you reach that watershed the continued cost of your borrowing eats up so much of any positive returns that you cant break even. Your operation becomes what might be called ‘walking dead’.

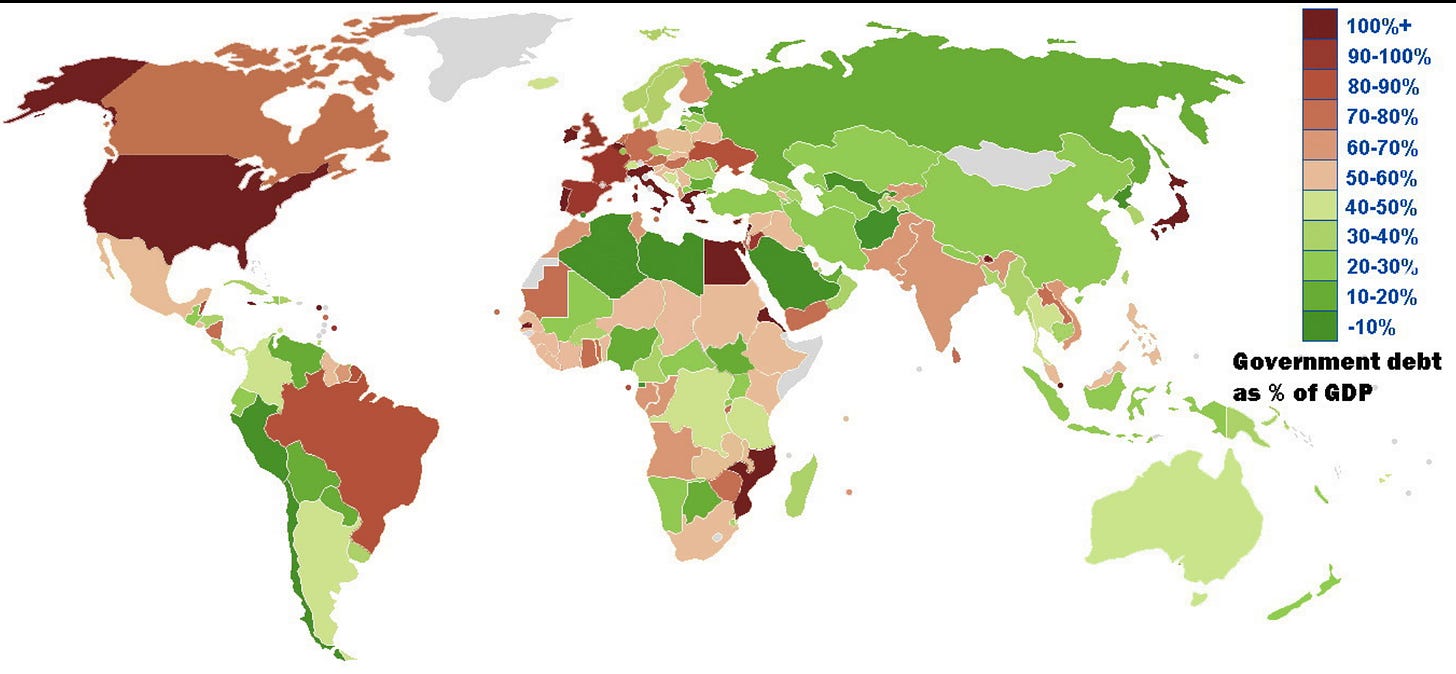

That is what is happening to the Western economies. A perfect example is the government of the USA, which has a debt that is 127% of the underlying economy’s value. And it’s rising on a monthly basis. That means the interest costs of the debt already built up eats so much of any profit the economy can make so that each operation simply adds to the accrued debt. In other words the country is borrowing to lose money, which is absurd.

The effect of such a situation is to trash the currency, which is what is incorrectly called inflation. It isn’t inflation at all, but debt trap currency debasement.

Inflation is when things get more expensive. Only they tend to do the opposite if not hindered. I bought a chainsaw twenty years ago. It cost me €150. Five years ago I replaced it for a cost of €99. It’s only one example, but I could give many. The general tendency in a technological world is for technologies to be able to work better over time, and therefore to operate more cheaply. The ‘inflation’ we have to put up with is currency debasement.

With that goes increased taxation in a futile attempt to pay for the financial mistakes.

With that goes a decreased standard of living. And with that goes an inability to pay for more expensive things, which in turn ultimately leads to a sagging, and then retreating real estate market.

Remember the rule: House prices rise to their level of affordability, but not much further.

As their affordability decreases so do the prices.

In other words, if you own real estate in a debt-trap economy you are looking at an asset that is likely to be starting to decrease in value.

How do you find out?

Easy. You look at a country’s debt to GDP ratio. If it is hovering around the 80% mark, the economy is heading into the debt trap zone and your real estate assets are at risk. If it is over 90%, then you are in serious trouble

Two of the worst countries where real estate prices are at serious risk are Japan and the USA, but rather a lot of EU countries are heading that way at a serious rate of knots

Now look back at the previous parts of this three part series, and draw the obvious conclusion. As the BRICS+ countries move ahead they will be the countries where house prices will start to rise.

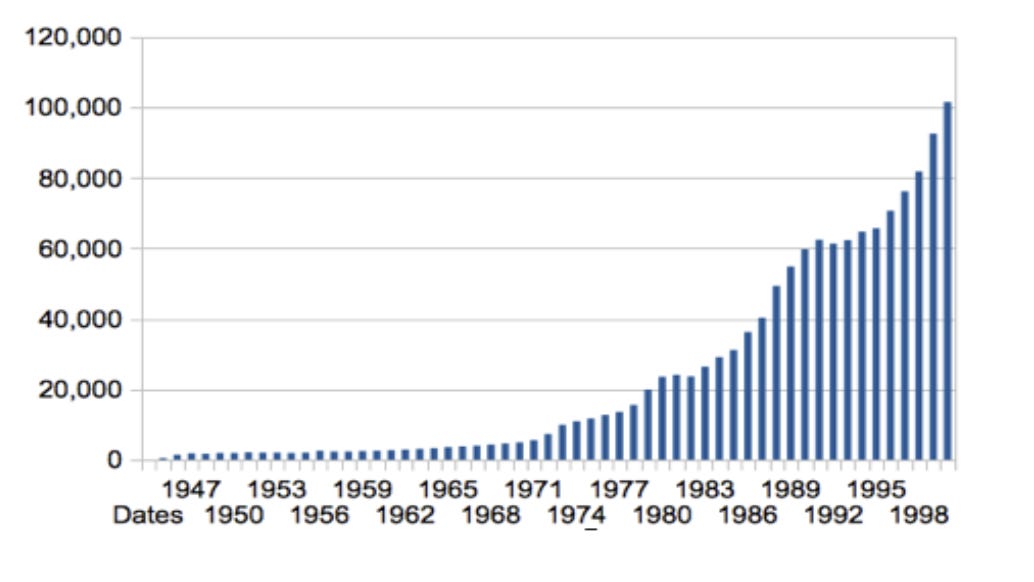

Remember that chart I showed you in Part 1? Here it is again. When did house prices start to rise?

It was when the working class had a disposable income as opposed to subsistence wages. And when that was coupled with wages increasing faster than inflation, as well as when the country supports a sophisticated financial structure offering mortgage facilities, house prices will start to rise significantly

In other words the countries where house prices are starting to rise are those countries that are now in the emerging countries club.

Obviously there are always other issues to be aware of when buying abroad. You need to understand the laws of that country. You need a local legal team, and you need to know what protection is given to landowners in the country. You are also investing in a country as well as in some real estate. Is the country worth investing in?

That’s a whole other matter to worry about. But a lot of information on that count will be obvious from the Debt to GDP figures given above.

Share this post