Investing Rules Part 3

Bitcoin, Blockchains, Gold

Okay, so I am invested in Bitcoin, blockchain technology and gold.

Taking the first golden rule I would not invest in Bitcoin now as it is no longer at a low price, and the asymmetry (possible gain -v- possible loss) is getting close to being non existent.

Blockchain is the technology of the future. It is the place to be. Gold, as always, is not an investment but a safe haven, but there are ways to get the best of both worlds. One way would be to invest in gold mines, another would be to invest in gold related industries which pay a good return.

There is another rule which I haven’t yet mentioned, which was told to me by my financial mentor who, as those of you who follow my writing will know, was Sir John Templeton. He told me that when I started to work for myself (which is another golden rule — Why work for other people?), I should remember to make sure my operational structure works on three levels. I should live in one country, be domiciled in a different country, and my income should come from a third.

Here’s an example of what I mean. Suppose you hold a British passport, it would probably be a good idea to live somewhere else. You could bank in the Isle of Man, and maybe follow me and invest in refining gold. That company is based in West Asia.

It’s a bit late to get into bitcoin, but that would be useful for folks living in The West, as just about every western currency is financially on the rocks, whereas bitcoin is going from strength to strength.

You should have your business based in a rich country where prices are high, and you should live in a relatively poor country where your money goes a lot further.

All these rules are disarmingly simple, and obvious, but so few people pay attention to these things.

One of the snags of living in modern day USA is that the options to split up your life into three parts is far more limited than for people who live in Eurasia, but it is certainly possible.

In the meantime I noticed a boring write-up by a company calling itself K2 Private Wealth. It focuses on stock market returns, which seems to me to be about the worse place to invest, and the final take away is “the investment landscape is more nuanced than the strong start to the year suggested. There are opportunities, particularly in selective European cyclicals and quality UK assets, but the bar for returns is rising. Staying diversified, disciplined, and focused on long-term objectives remains the best defence”.

In other words the guy writing this stuff is ignoring every basic rule in investing. Which stock market is currently at a low? None, so dont put your money there. Where is an asymmetric deal to be had in any stock market? And so on.

This guy doesn’t tell us how well he did with his investments last year. Why listen to him? My investments are doing so well my readers dont believe me and claim my investments are risky. Sounds like I’m doing well. So what do I think?

In my opinion, now is just the time to be aggressive, not defensive. Being defensive with economies failing and inflation rising is a lunatic solution. You need to search out the new, cheap, and aggressive businesses, and invest in them. And you need at least some insurance, and that means gold.

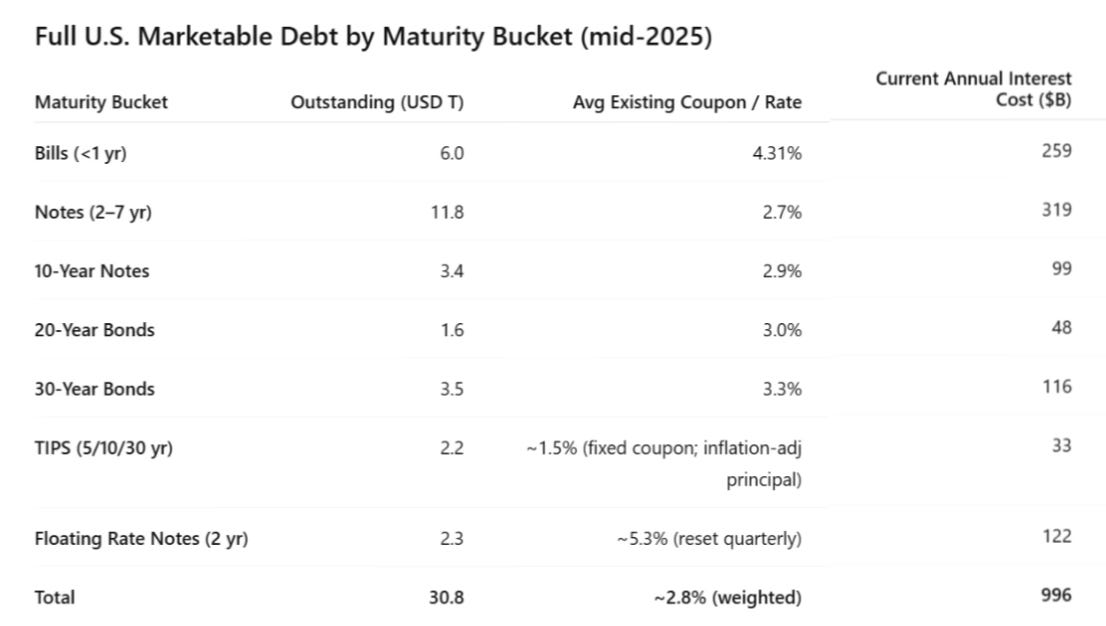

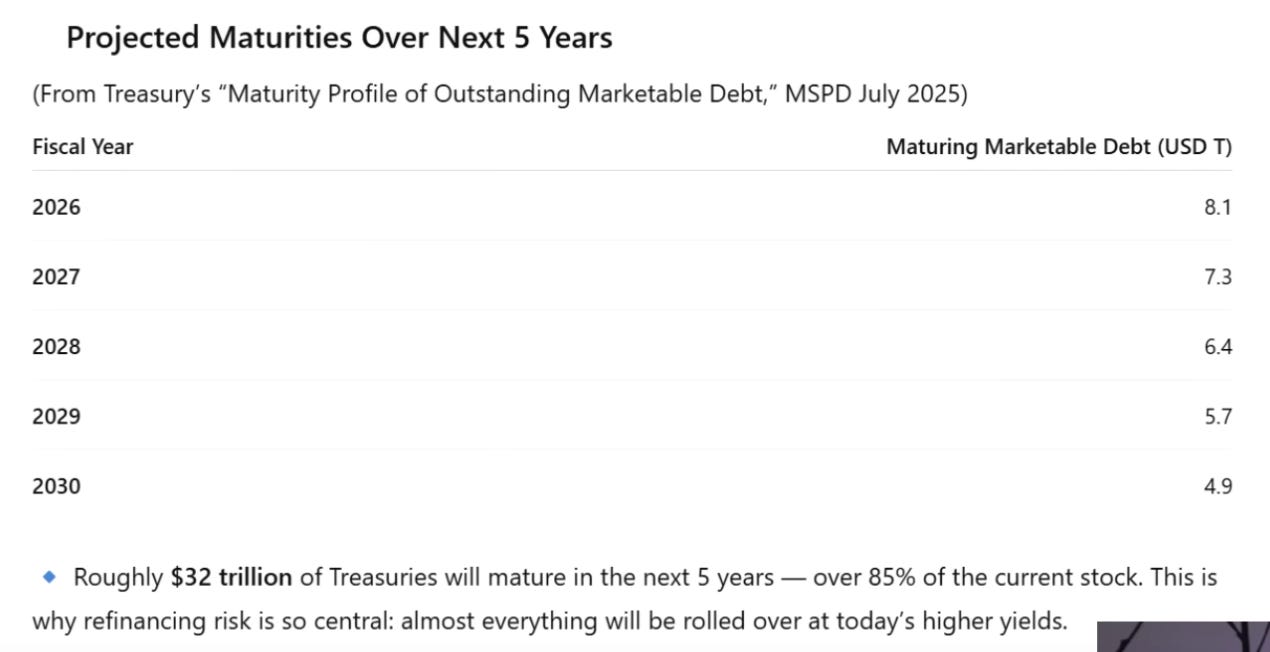

As we move into the autumn life is going to be very difficult for the government nerds in Washington, as the spectre of disastrous bond sales looms. However you look at things the finances of the USA are a time bomb waiting to wreck the country.

The dollar is still officially the world’s reserve currency but as of the beginning of September 2025 not only is it not backed by gold, it is also now only partly backed by the rather shaky faith in the US government.

The US government is effectively telling the rest of the world that the dollar is now backed in part by bitcoin. This means the latest bond issues will have a bitcoin element backing them.

What a turn up for the books: the dollar needs some backing from bitcoin! It was only the equivalent of last week that so many punters were complaining that bitcoin was a scam, and was backed by nothing.

Does this mean the world has a reserve currency that is no longer backed by anything?

Let me put that another way. The world’s supposed reserve currency is now backed by ‘the full faith of the government of the USA’, a support which lacks substance as the government of the USA is bankrupt and supported by foreigners who lend it money, and that support is helped by an upstart entity which is apparently a scam backed by nothing. You couldn’t make this up.

America Inc is not about to disappear, but The Empire is made of straw and looks about to burn to the ground. However, with the USA’s debt situation worsening month by month, how can the country look forward to lower interest rates? How long before foreigners need 10% rates to lend to a profligate spender

Now let’s take this a stage further. We keep being told we are either in, or on the edge of world war three. Let me ask one simple question. Who is going to pay for it? It certainly isn’t the USA because they only have debt, and you cant fund a war with low grade bonds. The USA has no arsenal available to even start a war yet alone fund one lasting more than a couple of weeks.

But a modern war may only last 45 minutes. That will mean the USA wins, but in that case almost all life on earth ceases.

The alternative is that the USA gets wiped out.

Let’s move our arguments towards a more realistic view. Only an idiot starts a war when they dont have the money to take it beyond a week or two? In the case of the USA neither do they have the ordnance?

Oops! The politicians in charge are morons so maybe we should expect the worst.

Might I suggest that the idiots supposedly in charge are maybe about to be upstaged.

At least, I hope so. It would be embarrassing to be wiped out by a moron or two.

Nest week I will be more specific about where I am investing my money.