How much is a house worth? How do we work out its real value, and most importantly, whether it’s too expensive or indeed really cheap?

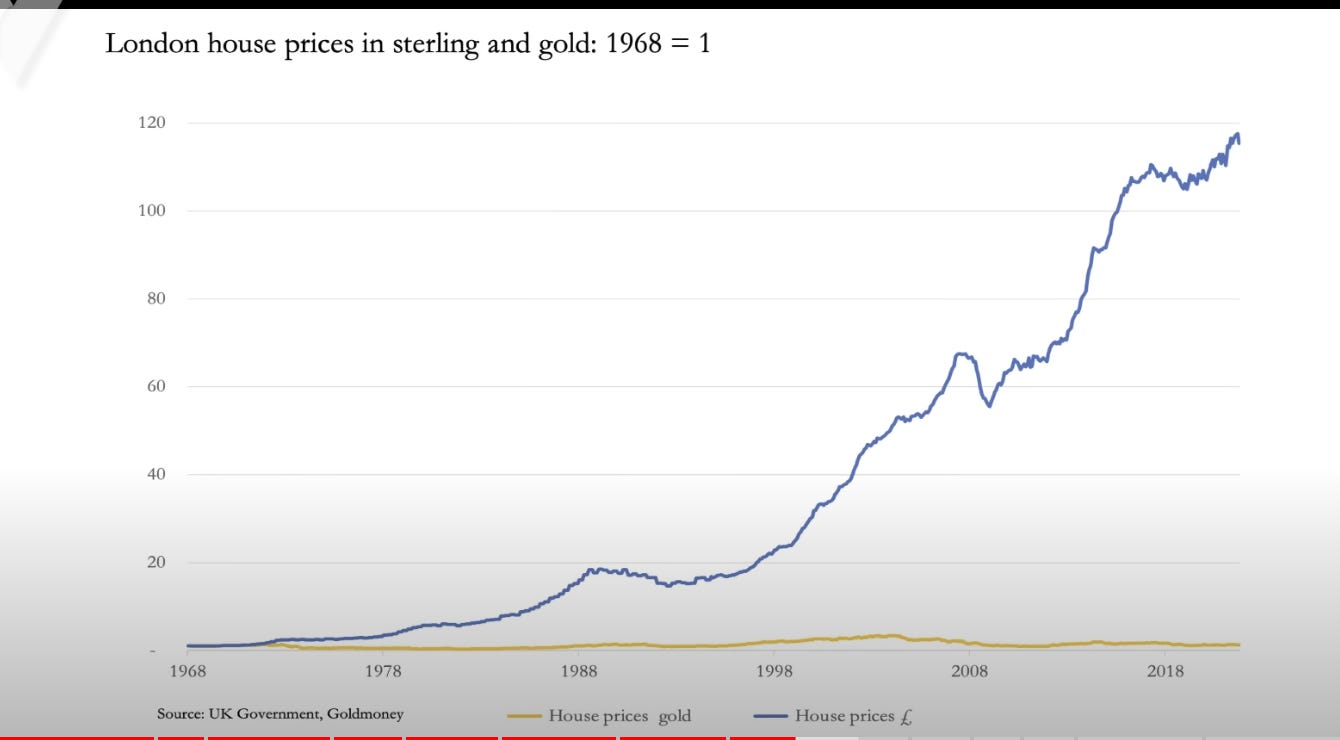

Let me start with a rather unusual chart. This shows the value of a house priced in gold against sterling. It emphasises a basic fact that house prices dont just go up, they tend to track inflation. In other words, the following chart is really showing just how much sterling has depreciated over the past sixty odd years. Houses, valued in gold, haven’t moved at all. Welcome to the world of fiat currencies, where the value of the currency just keeps on falling due to the financial delinquency of governments.

In one sense, the above statement should be obvious. After all, my first wage as a supply teacher was £8.50 for half a week. By comparison, back in the nineties I was getting £31 an hour. Since modern mortgages became available the average house could only be priced in terms of how much money the average buyer took home at the end of the month. This is why house prices cant keep going up, they simply adjust to the value of the currency. Houses are therefore clearly a hedge against inflation, just like gold.

If we are to start seeing the return of a gold standard over the next year or two courtesy of the BRICS nations, that should help stabilise house prices, but probably only after a nasty blip down for those priced only in fiat currencies.

But how do we get to value a house?

Remember the distinction made by Oscar Wilde. There are two prices for everything. The price and the value, and they dont necessarily come out the same.

If you ask an estate agent, he will tell you the price he thinks he can get for a house. He probably has no idea about its value.

If you ask a valuer, he will be able to tell you what a similar house sold for last week, but again, he probably has no idea about the house’s value.

I have used two metrics to find the intrinsic value of a house. That is the figure I am most interested in. I next look at the price and see whether the price is above or below the intrinsic value. If above, I dont buy. If below, I start to get interested.

In last week’s blog I mentioned the following deal.

In 1988 an apartment sold for £47,000. Five years later I bought it for £20,000. Five years after that it was apparently worth £130,000. Which was the real value of the apartment, or did it's value really gyrate at such a dizzy pace?

The real answer to that question is that its value did not change at all, but its price did, which is precisely what brings up opportunities.

If I live at number 4 Elm Street and you live next door at number 6, and our houses are pretty much the same, then they should be worth the same. If I pay a mortgage for my house and you rent yours, our accommodation costs should, ideally, be roughly the same.

Let's say I am buying my house with an average mortgage with an average interest rate, then the cost of that mortgage (the interest) should be roughly the same as the cost of your rent. If you are paying £100 a week rent while I am paying £150 a week in interest on my loan then very soon I am going to question why I am paying so much more than you are for the privilege of living in an almost identical house. I am going to think it would be a better deal to rent rather than to have this ridiculously expensive mortgage.

Eventually, market forces will come into play and people like me will start renting rather than buying. This will force rents up. Over the long term the cost of a mortgage and the cost of rent will tend to be similar. Obviously, over time they do vary, and that is what throws up buying or selling opportunities.

Please note I do not include the cost of buying the house, only the cost of the borrowed funds. However the total costs to the mortgage holder must include the opportunity cost of any deposit he has put down.

I explain opportunity cost in my book The Ultimate Real Estate Guide.

When I did the 2012 revision of that book I was involved in a question of house swapping. There was a nice five bed villa in the Algarve with 2.25 acres of land and a swimming pool priced at €425,000. That was officially cheap (according to the local estate agent). It rented out for about €1,000 a month. The cost of the mortgage on that villa at 80% loan to value with mortgage interest rates at 4% was €13,600 p.a. The opportunity cost of the deposit we'll say is also 4% to make our calculations simple, in other words €3,200 p.a. Total cost of the money involved: €16,800 p.a.

Rent at €1,000 a month costs €12,000 p.a., giving us an annual difference (loss) of €4,800. And that does not include the purchase costs. That is not what I call a good deal. Of course, you now have to add in the costs for taxes and repairs, so the final cost of buying this house is even more,

Supposing I’d decided to rent instead, I would be financially a lot better off than the idiot who bought the house.

Now you have at least one way of valuing a house.

A slightly different way of doing that calculation would be to find out what a similar place rents for, multiply the annual figure by ten, and you have a rough guide to the real value.

There is a more sophisticated way to do the sum, but I dont propose to go into the full details here. If you want all the ins and outs, you need to buy my book. There will be a link at the end of this article.

In my book I also show how you can use these figures to work out what is the best way to manage your money. The crucial figure is always the one where you buy either as close to the intrinsic value, or better still, below that figure.

If the purchase price is too high, then the sensible thing to do is to rent. If you rent and save the difference, when prices come down you will at least not have to borrow the deposit.

It’s all terribly simple really.

Here’s the link to my book, The Ultimate Real Estate Guide: https://www.amazon.co.uk/dp/B07D3ZW8D2