I am not someone who is keen to tell others what to do. Perhaps I am a coward and would hate to think I’d got things wrong, but generally, if I look back at my predictions, I find I have done very well. But the usual caveat rings loud in my ears: Past success is no guarantee of future success.

So where are we, and what do we want from the investment world?

We want a buy point.

That means we are looking for a crash so we can do what is the best advice in the world of investing.

We want to buy low and take advantage of a subsequent rise in prices.

If you want to see what I mean, simply take a look at what happened over the past hundred years or so. Whenever investment situations looked dire, that was the time to sit down and pay attention. You look for the seeds of recovery and BUY!

I also look to see if people I have found reliable think the same way. Finding those people is not easy. There is a lot of noise out there.

So where are we at the moment?

The answer to that is clear. We are in one hell of a mess.

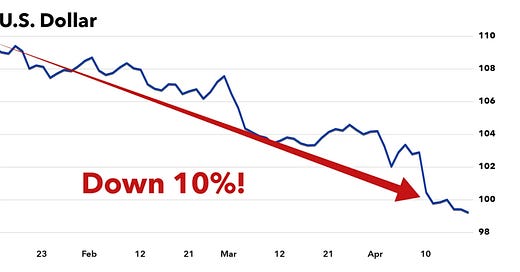

The following is an analysis based on the most important current financial situation on the planet. I refer of course to the state of the US dollar.

In short, that currency is tanking. The US deficit is dragging the country down, and threatening life in the USA. Just look at its value set against what has been regarded as real money over the past 3000 years or so; and that is gold.

It is clear to see why. Just look at the debt to GDP figure, and the implications for the bond market, and the ability of the USA to cope with a debt situation that is way out of control, threatening to crash the US economy and the country’s ability to survive financially.

You cant borrow your way out of a situation where borrowing money creates a worse financial situation. That situation is called a debt trap. A country enters that state of affairs when its debt to GDP rises above 90%. In other words if that figure is over 90% the country is borrowing to lose money. That is financial insanity. Currently the USA figure is north of 130%. That’s disastrous, and means that the country is paying more than $1 trillion dollars a year in interest alone. That is a recipe for financial armageddon!

The USA has been here before. In recent times it was in this mess just after the second world war. Then again in the seventies, and again during and after the dot com bubble. If you look at the state of the stock markets during those times you will clearly see a blow-out in the value of stocks, followed by a bubble bursting, leading to a crash, and on each occasion this was followed by a consistent and sustained return of confidence and value, and therefore a chance for ordinary investors to make money.

Put that in slightly different language, and you get the ideal situation to take advantage of the basic mantra for investment success: Buy low and sell high. If you dont believe me, simply look at the charts. It’s all there for anyone to see.

The trouble with the US economy, and the condition of the US$ in particular is that the US government spends more than it collects in taxes. That means the government has to borrow to pay its bills. It does that by selling debt in the form of Treasury Bonds.

Unfortunately there is a snag to that mechanism. Not only does no-one want to buy those bonds, people and governments already holding those bonds are selling them. In other words no-one is keen to buy US government debt. So what is going to happen later this year when the government will need to roll over rather a lot of the debt which is coming due?

The value of T Bonds has been falling over the years precisely because there has been so much selling due to the fact that there is widespread belief that the US is going broke.

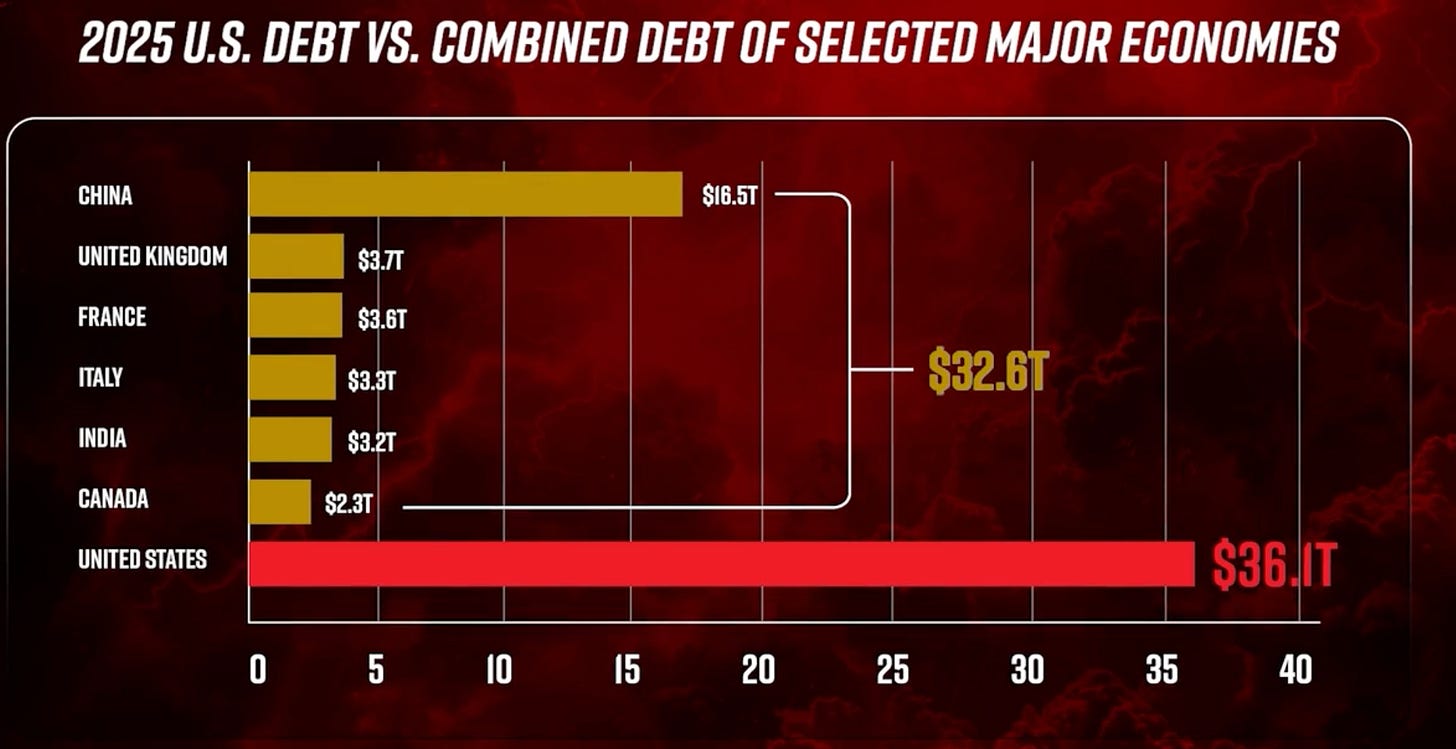

Just look at the level of debt compared with other major countries.

Now look at the sheer quantity of that debt which has to be repaid or rolled over this coming autumn.

7 trillion dollars worth of debt needs to be refinanced.

There are only two ways this problem can be resolved. First, to encourage foreign governments to continue lending the interest payable on the debt will need to rise significantly, making the debt level rise significantly.

The alternative is for the Federal reserve to buy the bonds. To do that they will have to create the money needed out of thin air. That will tank the currency.

There is one other option which I will go into next week. That may happen, and if it plays out as expected, that will first tank the stock market. But I will explain what I mean in next week’s blog. Dont miss it!